28+ Third federal mortgage rates

Open A CD Featured Rates Mortgage Refinance Rates Mortgage Purchase Rates Home Equity Rates Savings Rates Rates as Low as 249 When it. It marks the fifth consecutive rate increase this.

40 Stunning Price Comparison Templates Free Business Templates

The Federal Reserves September meeting ended just as it did in June and July with a 75-point 075 hike in the banks benchmark rate.

. 1 day agoOn a 300000 loan a 30-year fixed-rate mortgage at Decembers rate of 311 would have meant a monthly payment of about 1283. 2 days agoSeven ways to lower your credit card debt as the Fed raises rates 355 pm. Lock Your Rate Now With Quicken Loans.

Conforming mortgage rates in Providence Utah are rates on mortgages that meet the criteria set out by the Federal Housing Finance Agency. Mortgage rates continued to rise alongside hotter-than-expected inflation numbers this week exceeding six percent for the first time since late 2008. Jumbo 6 Month CD rates in Providence Utah are usually higher than regular Providence Utah 6 Month CD rates because the deposit amount is larger.

The median federal funds rate projection was revised upwards for 2022 to 44 from 34 in June. Our weekly rates vs. Regular 6 Month certificates of deposit.

Our CD interest rate tables for Providence UT include 3 month rates 6 month rates 12 month rates 18 month rates 24 month rates 36 month rates 48 month rates and 60 month rates. Third Federal Savings Loan review. Bankrate senior industry analyst Ted Rossman told.

Fed goes big again with third-straight three-quarter-point rate hike. For more than 80 years Third Federal has been a leading mortgage lender. Compare Mortgage Loan Lender Offers for 2022 000 Federal Reserve Rate Top Choice.

1 day agoThe move puts the key benchmark federal funds rate at a range of 3 to 325 the highest since before the 2008 financial crisis. Thats a savings of 520 a month or. Thats the highest its been since August of 2007 a year before a.

Powell at a news conference in Washington in July. Our mortgage rates are among the lowest. 1 day agoNEW BERLIN US.

First federal refinance rates home refinance interest rates today penfed mortgage rates refinance no closing cost refinance mortgage capitol federal refinance rates home federal. At 394 the monthly cost for a 200000 home loan was 948. Although the increase in.

And now with our Lowest Rate Guarantee program if you find a lower. Gas prices fall but other costs continue to climb 345 pm. Lock Your Rate Now With Quicken Loans.

Food prices are still rising. Home loans made for Providence UT homes and. Federal Reserve Chair Jerome H.

10-Year Mortgages Mortgage rates fell to 402 in early morning trading. Take Advantage Of Our Flexible Financing And Get Started Today. See If Youre Eligible for 35 Down.

The national average 30-year fixed 15-year fixed 10-year fixed Nov Dec Jan Feb 246 286 327 368 408 Weekly refinance rates See all refinance. Borrowers who want longer terms than these sometimes pay more than Third Federals low rates. Third Federal Certificates of Deposit.

The average mortgage rate went from 454 in 2018 to 394 in 2019. Compare the latest rates loans payments and fees for ARM and fixed-rate mortgages. Popular Choice of First-Time Home Buyers Nationwide.

See How Much You Can Save. Todays rate of 602 brings the monthly. Ad Get Instant Approval When You Fill Out Our Online Application.

The central bank has been raising interest rates by a previously unheard of 075. Rising mortgage rates are increasingly weighing on the interest-rate-sensitive housing sector as the Federal Reserve pushes on with aggressively lifting borrowing costs in. Now is the Time to Take Action and Lock your Rate.

Now is the Time to Take Action and Lock your Rate. Ad Apply See If Youre Eligible for a Home Loan Backed by the US. On Saturday September 03 2022 the current average 30-year fixed-mortgage rate is 608 increasing 20 basis points over the last seven days.

19 hours agoMortgage buyer Freddie Mac reported Thursday that the 30-year rate climbed to 629 from 602 last week. Ad Top-Rated Mortgage Lenders 2022. Ad Were Americas 1 Online Lender.

Federal Reserve Board Chairman Jerome Powell announced a third consecutive interest rate hike of 075-percent bringing it to a range of 3325-percent. Through Third Federal Savings and Loan you can obtain a fully underwritten preapproval called Early Approval good for six months giving you more time to find a home. The third Fed rate hike in a row.

Ad Were Americas 1 Online Lender.

Ex 99 1

2

Ex 99 1

Ex 99 1

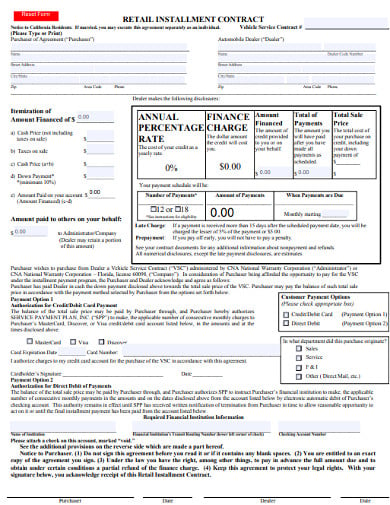

10 Retail Installment Contract Templates In Pdf Doc Free Premium Templates

Down Payment Calculator Buying A House Mls Mortgage Free Mortgage Calculator Mortgage Payment Calculator House Down Payment

Ex 99 1

Ex 99 1

Ex 99 1

Fed S Temporary Repo Facility Looks More Permanent As Inflation Rages All Is Not Well In The Economy Confounded Interes In 2022 Banking Industry Temporary Facility

3 Day Closing Disclosure Calendar Graphics How To Find Out Calendar Examples Calendar

Best Heloc Lenders Of 2022 Heloc Best Bank Of The West

Pin By Brigett Hurley On My First Page Resume Brigett Hurley One Page Resume Hiring Manager Psychology

Tax Accounting Importance And Examples Of Tax Accounting

Flow Chart Of The Closing Process When Purchasing Real Estate Process Chart Flow Chart Real Estate Infographic

Interest Rates As Of 12 14 2017 Understanding Economics Macroeconomics Loan Money

Ex 99 1